The "Great Retreat" has begun in the consolidation market!

Time:2022-12-29

Views:313

The latest World Container Freight Index [WCI] report released by Drewry, a shipping consultancy, showed that the spot freight rates of containers continued to decline this week, especially the freight rates of the Asia-North Europe route were lower than before the epidemic.

The latest World Container Freight Index [WCI] report released by Drewry, a shipping consultancy, showed that the spot freight rates of containers continued to decline this week, especially the freight rates of the Asia-North Europe route were lower than before the epidemic.

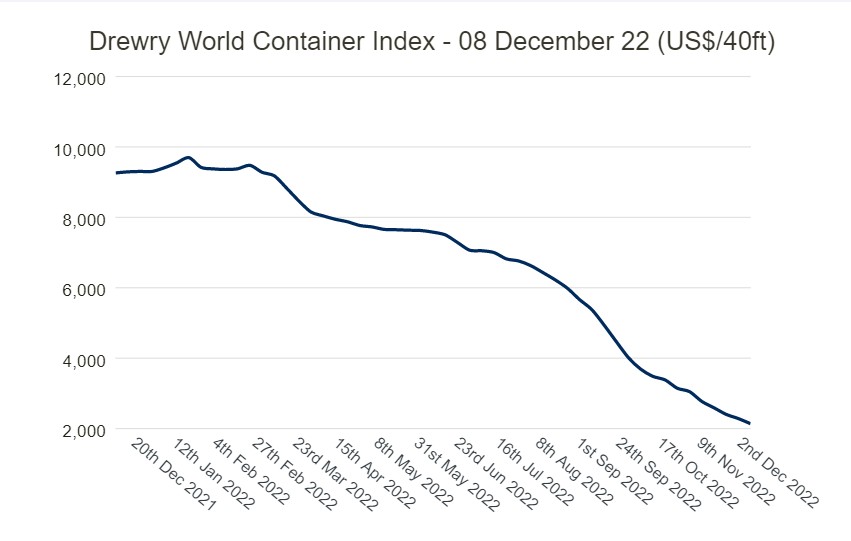

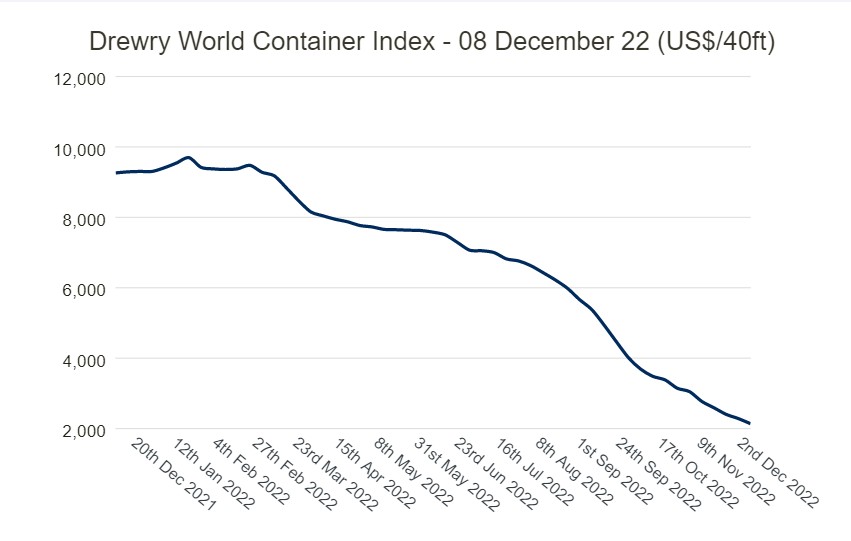

According to the latest World Container Freight Index WCI report released by Drury Drewry, a well-known shipping consultancy, on December 8, the WCI index continued to fall 6% this week to US $2138.70/FEU.

This is also the 41st consecutive week of decline, down 77% from the same period last year. 79% lower than the peak of US $10377 reached in September 2021. It is 21% lower than the average level of USD 2692/FEU in October. Drury said that this indicates that the freight rate has returned to a more normal level, but it is still 51% higher than the average freight rate of USD 1420 in 2019 (before the pandemic).

"New players" gradually withdraw from the long route

The sharp decline in freight rates of Asia-Europe and Asian-West routes has also led to the gradual withdrawal of new shipping companies from some long-route markets in the past two years.

Due to the sharp decline in freight rates, the British shipping company Allseas Global Project Logisitcs was ambitious to terminate the service of the China-Europe route before its establishment. According to the report of the shipping consulting company Linerlitica, the company filed for bankruptcy in October after failing to fulfill its lease commitment to deploy six ships.

In addition to Allseas, CULines also terminated the lease of 12 Panamax container ships currently deployed in the United States and Europe in advance in the near future (the owner company is Anton Holdings Co., Ltd.), and closed the bi-weekly Asia-Europe Express route jointly operated with TS Lines.

Alphaliner, a shipping consultancy, said in the latest market report that the relatively small ships owned by CULines and other companies are no longer competitive in the Asia-Europe trade routes under the current freight rates.

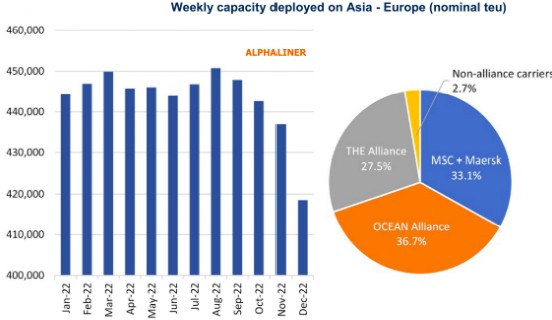

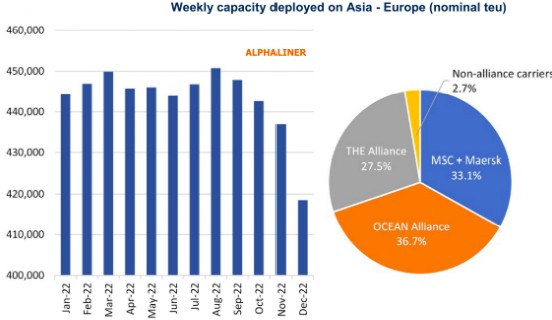

Alphaliner data also shows that on the one hand, new players are quitting the Asia-Europe route in succession, on the other hand, the large container shipping alliance is also reducing the ship capacity on such long routes.

As shown in the above chart, the data of Alphaliner shows that other liner companies have also cancelled some capacity in the past few weeks. As of December 6, the current average weekly capacity of the Asia-Europe market is 418500 TEUs, down 4.2% from the beginning of November, while the weekly capacity of August was 450750 TEUs, down 7.2% year on year.

Transport demand has dropped sharply

Lphaliner introduced in the latest market report (the idle capacity data is updated every two weeks) that the proportion of the global inactive container ship capacity has further increased to 5.3%. Specifically, in this month, although the number of inactive vessels decreased by 13, the number of inactive container vessels increased by 124897TEU, which Alphaliner said was because more and more large vessels were idle.

Alphaliner clearly stated that the proportion of the capacity of commercial idle ships has increased, accounting for 42% of the capacity of inactive fleet, while the proportion of the capacity of ships entering the dry dock for repair and maintenance has decreased, accounting for 58%, slightly lower than 60% two weeks ago. The number of ships controlled by the carrier in commercial idle decreased from 4 to 69, but the capacity increased by 96703 teu. This means that more and more large ships are idle.

Alphaliner explained that the increase in the number of commercial idle container ships was mainly due to insufficient demand.

The latest data released by the Container Trade Statistics (CTS) also accurately reflects this fact. The CTS data shows that after the sharp drop in container transport demand in September, the decline rate of container transport volume in October further intensified. In October, the global container transport demand measured by TEU decreased by 9.3% year-on-year, and also decreased by 4.3% compared with that before the pandemic in October 2019.

However, from the perspective of supply and demand, it is even worse if the demand is measured in TEU * nautical miles (considering the situation of navigation distance). In this case, the TEU * sea level actually decreased by - 12.8% in October (year on year), and by - 11.8% in September (year on year). Compared with 2019, the transport demand in TEU * nautical miles has also decreased by 7.7%.

Lars Jessen, a shipping analyst, said that in view of the continuous improvement of supply chain bottlenecks and the release of transport capacity, it is not surprising that the current container spot freight rate has entered the "hard landing" field, which is lower than the level before the pandemic.

However, the consolidation market is not all bad news. As mentioned in the latest report of Windruri, the decline of freight rates should be narrowed at least in the future. In addition, insiders have said that the adjustment of China‘s epidemic prevention policy may also be good news for the centralized transportation market.

Regarding the adjustment of China‘s epidemic prevention policy, Xu Jialin, an analyst at MSI, a British shipping consulting company, believes that, "In terms of ports and terminals, the optimization of epidemic prevention policies will improve the operational efficiency of the terminal and ease the congestion of container ships at the terminal. The cancellation of travel restrictions for residents will stimulate consumption to a certain extent and increase the demand for container imports; the factory will resume normal production, and the volume of export trade will increase, promoting the increase in the demand for container exports. MSI estimates that the tonnage released by the terminal congestion relief may exceed the increase in demand."

However, it still said, "On the whole, the downward pressure on the container market is large."